By Tom Benton & Vinay Shah, ReSource Professional —

The factitious intelligence panorama has modified considerably over the previous yr, presenting each contemporary alternatives and new challenges to the property & casualty insurance coverage business. As AI continues to evolve, particularly by developments like GenAI, insurance coverage corporations should create sturdy governance frameworks to maintain AI use clear and moral.

What’s AI governance?

First, let’s set up the core of AI governance. An efficient method to governance features a set of processes and frameworks that guarantee regulatory compliance all through the AI lifecycle – whereas nonetheless permitting room for innovation. It also needs to handle key considerations like moral violations, transparency, explainability, and bias. Managing these considerations by pointers and construction permits us to comprehend the total potential of AI, with people nonetheless within the loop.

How are carriers managing AI at the moment?

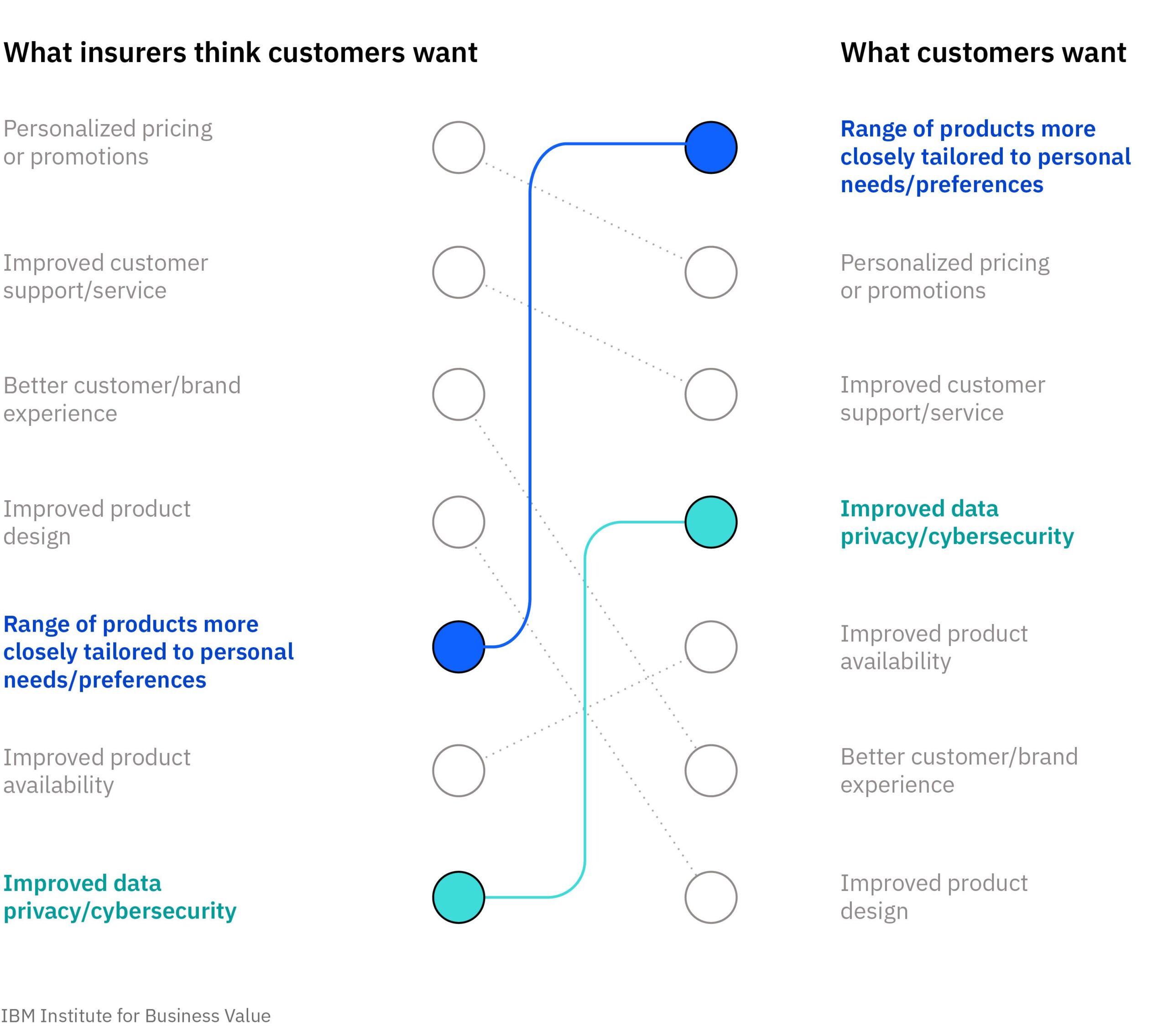

Many insurance coverage carriers have been utilizing AI for many years and have a transparent understanding of accountable AI administration. Nonetheless, with the emergence of instruments like GenAI, organizations should keep in mind new points, like content material accuracy and improper outputs. These concerns additional complicate creating governance frameworks. For many carriers (80%), the potential authorized penalties of AI are the best trigger for concern. Moral and social considerations are additionally top-of-mind.

For many insurers, AI planning duties are included into present administration and governance capabilities, primarily IT and information/analytics models. Nonetheless, over one quarter don’t have any formal construction, or grant duty to actuarial or particular person enterprise models.

The results of inconsistent AI governance

With out clearly outlined duties and governance fashions, organizations could battle inconsistencies. Along with taking over pointless assets, these points might make it harder to maintain up with innovation and laws.

Solely round one-third of carriers have short-term plans to develop an AI working mannequin or AI governance insurance policies. Practically half of respondents are specializing in AI and machine studying mannequin administration as a substitute. Whereas these areas are additionally vitally necessary, to higher handle their prime considerations, many carriers ought to significantly contemplate refocusing their efforts on working mannequin and governance.

How can we responsibly handle AI transferring ahead?

Choice-making processes could be streamlined if carriers place extra emphasis on integrating AI governance into current organizational constructions. That is additionally an necessary step towards aligning AI technique with broader enterprise goals. Nonetheless, with three doable organizational archetypes for carriers to contemplate, selecting the right method to control and handle AI responsibly could be difficult. Enlisting the assistance of consultants in digital transformation, AI, and information administration can assist you construct a governance framework that guides all features of AI growth, use, and monitoring throughout the whole enterprise.

About ReSource Professional

ReSource Professional brings built-in operational options to insurance coverage organizations to enhance progress, profitability and insurance coverage outcomes. Headquartered in New York, ReSource Professional’s international service facilities handle shopper operational wants across the clock. Acknowledged as an business thought chief and listed as considered one of Inc. 5000 Quickest Rising Personal Corporations yearly since 2009, the corporate is famend for its give attention to innovation, service excellence and trusted partnerships, and its distinctive productiveness platform for insurance coverage operations. Greater than 5,000 ReSource Professional workers present devoted help to a whole bunch of insurance coverage organizations, constantly reaching a +97% shopper retention price over a decade. For extra data, go to www.resourcepro.com.

SOURCE: Technique Meets Motion (SMA)