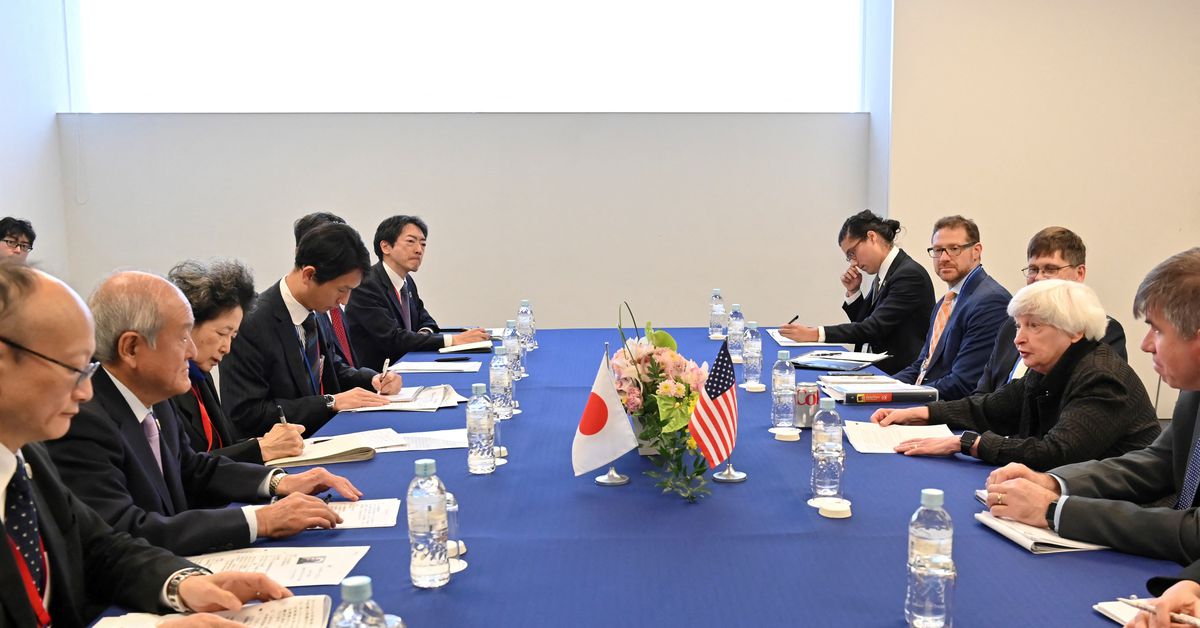

[1/3] US Treasury Secretary Janet Yellen and Japan’s Finance Minister Shunichi Suzuki maintain their assembly in the course of the G7 Finance Ministers and Central Financial institution Governors’ Assembly in Niigata on Might 13, 2023. …

NIIGATA, Japan, Might 13 (Reuters) – The present banking atmosphere and pressures on earnings of some U.S. regional banks could result in some focus within the sector, and regulators will possible be open to such mergers, Treasury Secretary Janet Yellen stated on Saturday.

Yellen advised Reuters she was not seeing proof of stress on smaller neighborhood banks, which had a big share of insured deposits. She expressed confidence that almost all banks had entry to enough liquidity to protect in opposition to surprising deposit outflows from uninsured depositors.

Nonetheless, she stated a sure diploma of consolidation within the regional and midsize banking sector might happen. She declined to debate any particular banks.

“This is perhaps an atmosphere by which we will see extra mergers, and you understand, that is one thing I feel the regulators might be open to, if it happens,” she stated in an interview on the sidelines of conferences of finance officers from the Group of Seven wealthy nations n Japan.

Yellen sought to reassure her G7 companions this week that the U.S. monetary system was steady, saying america had taken motion to strengthen confidence in its banking system after the failure of three regional banks since mid-March.

On Friday she advised Bloomberg TV that every one three of these banks had tended to have substantial losses and a really excessive proportion of uninsured deposits however that the general banking system was well-capitalized and nonetheless had “very strong earnings.”

Shares of main U.S. regional lenders have been extra risky in current weeks, with buyers nonetheless cautious in regards to the stability of mid-sized banks.

The KBW Regional Banking index (.KRX), which has fallen almost 14% thus far this month, rose 0.39% on Friday, however PacWest Bancorp (PACW.O), which misplaced 23% on Thursday after reporting a decline in deposits, dropped an additional 3%.

Yellen famous that stress on a financial institution’s inventory might unsettle uninsured depositors. “The unlucky dynamic is that after a financial institution’s inventory is below stress, it may well set off concern amongst uninsured depositors … although the financial institution has satisfactory capital and liquidity,” she stated.

Reporting by Andrea Shalal in Niigata; Modifying by William Mallard

Our Requirements: The Thomson Reuters Belief Ideas.